Thought leadership

- Date 29 September 2025

- Words by Team ESG & Impact

- Reading time 3 mins

Building Climate Resilience Through Natural Capital

Land-based assets, such as agriculture and forestry, deliver critical adaptation and mitigation benefits, from carbon sequestration and biodiversity conservation to water regulation and soil health. Yet, these assets are increasingly exposed to the physical risks of climate change.

Land-based assets, such as agriculture and forestry, deliver critical adaptation and mitigation benefits, from carbon sequestration and biodiversity conservation to water regulation and soil health. Yet, these assets are increasingly exposed to the physical risks of climate change. Intensifying hazards such as extreme weather events, droughts, floods, wildfires, and pest outbreaks threaten both the ecological integrity of these systems and the financial and social outcomes that depend on them.

Acknowledging the physical climate exposure of land-based assets does not diminish their value, rather it highlights the need for proactive and resilient management. By reframing these assets as natural capital and shifting away from extractive practices, we can embed climate resilience and strengthen protection against escalating risks.

At Climate Asset Management, we take a proactive approach to managing physical climate exposure across our natural capital assets. Guided by the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD), we apply a robust risk assessment framework alongside thoughtful asset design and management practices. While TCFD addresses both physical and transition climate risks, here we focus specifically on our approach to identifying, assessing, and managing physical climate risks.

Risk Identification and Assessment

We follow a tiered approach, with physical climate risk assessments embedded throughout our investment process, starting from initial deal screening. This ensures that climate considerations are evaluated at every stage of decision-making.

Initial Deal Screening

At the earliest stage, we leverage geospatial and hazard-specific datasets to identify potential physical climate risks. Tools such as Munich Re’s Location Risk Intelligence and World Resources Institute’s Aqueduct platform are applied to evaluate risks across multiple climate scenarios and time horizons. These outputs direct the next stage of due diligence.

Detailed Due Diligence

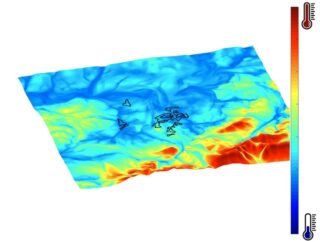

Where risks are deemed material, we conduct more granular site-specific assessments, often in collaboration with third-party experts. These may include water basin security, frost incidence mapping, or fire risk assessments, depending on the nature of the asset and its geographic location. These insights provides a robust foundation for decision-making by quantifying potential impacts and clarifying whether risks can be mitigated through asset design and management, or whether they represent constraints that affect investment viability.

Building Resilience Through Asset Design & Management

To invest with confidence in natural capital, we embed resilience from the outset by systematically mitigating physical climate risks. Our approach is guided by a mitigation hierarchy that ensures resilience is embedded across the asset lifecycle:

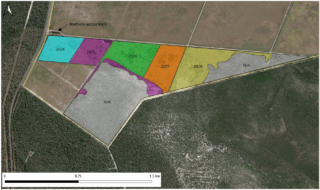

- Avoid high-risk locations through detailed due diligence, informed by location-specific assessments and scenario-based climate risk analysis. This is where the opportunity to build resilience is most immediate – during deal screening. For example, in Iberia, we conducted a high-level water basin risk assessment early in the process, which enabled us to target areas with more secure water availability. This kind of strategic screening allows us to steer capital towards locations with stronger long-term climate resilience.

- Minimize the duration, intensity, and extent of potential impacts with preventative measures such as fire breaks, fire ponds and flood buffers.

- Manage residual risks by promptly responding to new information and adjusting our approach – through preventative infrastructure, recovery planning, and insurance, where available and effective.

This hierarchy translates directly into practical measures on the ground. In our sustainable forestry investments, for example, species selection and diversification are central to resilience. Planting climate-adapted or mixed-species stands helps us reduce vulnerability to pests, disease, and shifting weather patterns. In regenerative agriculture, integrating hedgerows, riparian buffers, and biodiversity corridors strengthens ecosystem health, stabilises soils, and protects water resources. These design choices not only reduce exposure to climate shocks but also enhance the long-term productivity and ecological value of the land.

Operationally, climate risks form an integral part of each asset’s risk register, which is actively managed and reviewed on a regular basis. This ensures that emerging physical climate risks, such as shifting rainfall patterns or increased wildfire frequency, are captured and addressed. The risk register plays a central role in informing the asset protection plan, which translate identified risks into practical mitigation and resilience measures.

Asset protection plans ensure preparedness when hazards do occur. Monitoring systems, early-warning protocols, and rapid response frameworks provide the capacity to act swiftly and minimise damage, safeguarding both ecological integrity and financial performance. This connection between risk identification and operational response is key to embedding climate resilience across the asset lifecycle.

From Risk to Opportunity

Proactive resilience does more than protect against loss — it enhances asset value, safeguards ecosystems, and strengthens the communities connected to them. By identifying physical climate risks early and examining them thoroughly where material, we ensure that exposures are understood and actively managed throughout each asset’s lifecycle.

This disciplined approach reduces downside risk while also positioning our portfolios to capture the long-term benefits of climate resilience. Resilient forestry and agricultural assets are better placed to withstand climate shocks, deliver consistent returns, and maintain ecological integrity. They also generate co-benefits, such as from biodiversity gains or improved water security, that reinforce the durability of value creation over time.

In short, investing in resilient natural capital is not just about protecting against climate risks. It is about converting those risks into opportunities for sustainable growth, stable returns, and measurable positive impact.

Disclaimer: This article is based on Climate Asset Management’s ESG & Impact risk assessment framework and is provided for general information purposes only. It does not constitute investment advice or policy guidance.