Thought leadership

- Date 24 November 2025

- Words by Carl Atkin-House

- Reading time 7 mins

Opportunities in Natural Capital: The Current Investment Landscape and Portfolio Benefits

In this article, we examine the growing opportunity in natural capital, outlining the current investment landscape and the role these assets can play in improving portfolio diversification, resilience, and long-term risk-adjusted returns.

Introduction

The last century has been a success for humanity in so many ways – we have never lived as long, healthy and prosperous lives as we do today. Yet, we have to acknowledge, this success has come at huge environmental cost. Our economic prosperity entirely relies on the nature that surrounds us and of which we are a part – it is not just the food we eat and fibre products we consume; nature is fundamental to the quality of the air we breathe, the water we consume and the decomposition and recycling of waste.

“Natural Capital” refers to the parts of nature that provide benefits and services to people and the economy. Healthy natural capital underpins global prosperity. It provides the air we breathe, the water we drink, and the environment we inhabit. It also enhances public health and helps communities adapt to climate shocks. For example, wetlands and mangrove forests can mitigate flood damage, while fertile soils can support food security. Conversely, degraded ecosystems heighten vulnerability. Over 55% of global GDP is moderately or highly dependent on nature[1], making nature loss not just an environmental issue but an economic one. As recognition of this grows, safeguarding and managing natural capital is becoming a cornerstone of global financial stability.

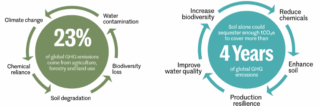

With an extractive approach (Figure 1) to natural capital management and development, the biosphere has diminished rapidly.

The rapid loss of species we are seeing today is estimated by experts to be between 1,000 and 10,000 times higher than the natural extinction rate[2]. To this add the other unsustainable land management practices associated with agriculture and the negative effects are startling: Globally, food systems alone are not only the primary user of land, but they are also the largest driver of nature loss[3].

The legacy of industrial land management approaches is one of increasing production efficiency coupled with increasing degradation of biodiversity and soil fertility, posing challenges to the planet’s ability to continue to produce food and fibre for a rapidly growing population, particularly in the face of increasing climate and weather volatility. It is now clear that a restorative and regenerative approach to land management is fundamental to ensure the economic and environmental resilience of future food and fibre systems and contribute to solving the climate crisis.

The Funding Gap

To reverse the decline in biodiversity by 2030, analysis suggests that circa USD 700 billion needs[4] to be spent each year over the next ten years. Mobilising institutional capital, alongside a whole range of other funding streams, towards responsible natural capital investment is therefore fundamental to reversing this biodiversity decline and ensuring that natural capital plays its pivotal role in mitigating the negative effects of a changing climate.

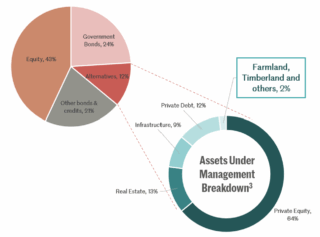

As shown in Figure 2 below, the sector is significantly underinvested by institutional investors: agriculture, forestry, and fisheries alone contribute 4.3% to global GDP, but less than 0.2% of institutional capital is focused on private natural capital assets.

Natural capital is fundamental to global economic output[5] and directly represents approximately 4.5% of global GDP, yet the sector remains severely underinvested with allocations to natural capital strategies estimated to account for just 0.2% of total AUM globally.[6]

Current State of the Natural Capital Investment Landscape

The natural capital land-based investment universe spans the more well-developed forestry and timberland space, farmland investments (particularly in regenerative agriculture) and landscape restoration projects which depend significantly or wholly on income from ecosystem services – notably carbon, biodiversity and water or other recreational services. Whilst significantly less developed, opportunities to invest in marine natural capital and marine ecosystem restoration exist through a wide spectrum of projects from sustainable aquaculture to the development of blue carbon projects linked to mangrove restoration.

Whilst some global timberland and agricultural investing markets are relatively well developed, such as in North America, many ecosystem services markets remain embryonic and fragmented, with challenges around market depth, liquidity and institutionalization. Some regions of the world have well established compliance carbon markets, notably Australia and New Zealand, whilst others have a patchwork of different voluntary markets with varying degrees of sophistication. Biodiversity, water quality, flood management and nutrient neutrality markets are even more nascent, with a handful of well-functioning examples setting the market standard.

Market standardization is helping to drive institutional engagement. For example, the implementation of Article 6 of the Paris Agreement is creating a more unified framework for international carbon credit trading, reducing concerns around double counting and credit quality inconsistencies. This regulatory alignment is helping to strengthen the legitimacy of carbon markets and attract additional institutional capital. Increasing disclosure requirements, particularly the Task Force on Climate-related Financial Disclosures (TCFD) and Task Force on Nature-related Financial Disclosures (TNFD) is encouraging investors to integrate climate and nature into decision-making and supports a shift in financial flows away from climate-negative and nature-negative outcomes.

The Current Market

In terms of capital deployed, globally there is approximately US$ 100 billion of institutional capital invested in timberland,[7] whereas currently institutional capital deployed in farmland is estimated at over US$ 80 billion[8]. Yet this geographically heterogenous: North America and Australasia account for a significant proportion of this capital, with many important markets, such as Europe, relatively underinvested. Whilst traditional managers of farmland and timberland are re-inventing themselves as managers of natural capital, many of the legacy operating models in this space are based on relatively passive ownership relying on tenants to manage the land whilst riding a passive land price appreciation wave. Changing the approach is fundamental: we need to move beyond simply managing land ‘sustainably’ and thus we need active management by philosophically aligned and impact incentivised operating partners focused on more durable returns and value improvement through land restoration. 38% of global agricultural land is already affected by degradation and thus we need to improve land management practices to reverse the damage caused by historic practices rather than simply making current practices ‘sustainable’.

Investment in stand-alone ecosystem service markets is a currently a fraction of the traditional timberland and farmland space but is growing rapidly. The challenge here is to find the right projects of institutional quality to invest in, given the early-stage nature of many of the project developers in this space. Deep manager expertise is fundamental.

Portfolio Contribution: Natural Capital as a Risk Mitigant

Modern Portfolio Theory (MPT) allows investors to assemble an asset portfolio that maximizes expected return for a given level of risk. The theory assumes that investors are risk-averse; for a given level of expected return, investors will always prefer the less risky portfolio. Portfolio diversification is a basic building block of modern portfolio theory.

Combining uncorrelated assets in a portfolio increases expected returns without additional risk, thereby improving portfolio efficiency—making higher returns achievable at every level of risk.

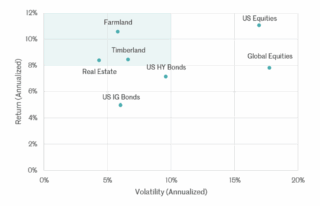

In traditional portfolios, opportunities to improve efficiency through diversification may be limited because the average correlation across securities can be high. This is especially true in crises, when traditional asset classes virtually all move down together. In contrast, the lack of correlation across diverse natural capital investment strategies offers great potential for efficiency improvements via portfolio design.

Natural Capital’s Role as a Risk Mitigant

The table below summarises the role of natural capital as a risk mitigant in portfolio construction.

Within this context, natural capital as an asset class demonstrates strong risk mitigation potential, offering diversification benefits and resilience against several of these broad risk categories.

Sharpe Ratio: Improving Risk Adjusted Returns

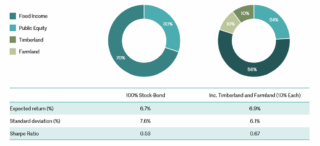

The Sharpe ratio is a measure of risk-adjusted return, calculated by subtracting the risk-free rate from an investment’s return and dividing that by the investment’s standard deviation. A higher Sharpe ratio indicates a better risk-adjusted performance, meaning the investment is providing more return for the level of risk taken. As shown in the analysis below (Fig 3), including natural capital in investment portfolios provides an increase in the Sharpe ratio of the portfolio compared to traditional fixed income and public equities.

In addition to portfolio decarbonization and aligning portfolios to the nature positive transition, natural capital brings significant other benefits to investment portfolios. Since food and fibre products are a central component of the inflation bucket, investing in these assets provides a real asset inflation hedge which is non-correlated with bonds, equities and traditional real estate.

Successful Implementation: Derisking Execution

Given the natural exposure of such investments to a range of natural risks (especially weather, climate and biological risks) careful selection of investment opportunities is fundamental from sourcing and due diligence to project implementation, management and exit if fundamental to de-risk execution and working with professional managers with deep sector and implementation experience is essential.

Some of the key factors for the successful implementation of de-risked natural capital investments include:

- Strategic selection of commodity and ecosystem service value chains: For example, in regenerative agriculture, this involves value chains aligned to sustainable consumption and dietary change, in ecosystem service markets, it means prioritizing those with robust market liquidity or long-term offtake arrangements.

- Rigorous assessment of land and site opportunities: Evaluating locations that demonstrate both environmental resilience and long-term economic viability, with strong potential to deliver meaningful transformational impact.

- Partnership with philosophically aligned operators and developers: Success depends on collaborating with operating partners and project developers who share the regenerative investment vision, can work effectively with institutional investors, and have strong financial and non-financial alignment mechanisms to ensure enduring economic and environmental value creation.

- Managing natural capital assets in a regenerative way is accretive to returns and long-term value creation. These objectives are complementary. Regenerating land makes food and fibre systems more resilient, reducing the need for input use, improving soil health and the water holding capacity of the soil, making production more stable. More resilient assets will become more valuable in the medium term, especially as degradation occurs in many traditional food and timber production regions of the world. Thus, managing assets to be climate and nature positive is not only the right thing to do, but also accretive to returns and value creation and provides significant optionality to create additional income streams, such as the monetisation of carbon from a traditional timberland investment.

Conclusion

Natural Capital is an important emerging asset class for institutional investors. It provides significant economic and non-economic benefits to investment portfolios, potentially improving risk adjusted returns and improving portfolio diversification. Anchoring natural capital investments around regenerative agriculture and sustainable forestry de-risks the asset class, with rapidly growing ecosystem services markets offering potential significant medium-term upside.

Disclaimer: This article is based on Climate Asset Management’s Investment team views and is provided for general information purposes only. It does not constitute investment advice or policy guidance.

Sources:

[1] Russo, A. (2020). Half of World’s GDP Moderately or Highly Dependent on Nature, Says New Report. [online] World Economic Forum. Available at: https://www.weforum.org/press/2020/01/half-of-world-s-gdp-moderately-or-highly-dependent-on-nature-says-new-report/.

2] World Wildlife Fund (WWF) (n.d.) How many species are we losing? Available at: https://wwf.panda.org/discover/our_focus/biodiversity/biodiversity/ (Accessed: 11 October 2025).

[3] Benton, T.G., Bieg, C., Harwatt, H., Pudasaini, R. & Wellesley, L. (2021) Food system impacts on biodiversity loss: Three levers for food system transformation in support of nature. London: Chatham House. Available at: https://www.chathamhouse.org/sites/default/files/2021-02/2021-02-03-food-system-biodiversity-loss-benton-et-al_0.pdf (Accessed: 11 October 2025).

[4] Fu, C.H. (2023) Timberland Investments: A Primer. Timberland Investment Resources. Available at: https://tirllc.com/wp-content/uploads/2024/02/Timberland-Investments-A-Primer-2023-02-14.pdf. [Accessed: 5 November 2025].

[5] Global AgInvesting (2019). Ag Sectors to Watch in 2019.

[6] UNEP (2021). Governments adopt first global strategy to finance biodiversity: Implications for financial institutions. [online] Available at: https://www.unepfi.org/themes/ecosystems/governments-adopt-first-global-strategy-to-finance-biodiversity-implications-for-financial-institutions/.

[7] World Economic Forum (2022). Available at: https://www.weforum.org/agenda/2022/05/nature-positive-net-zero-global-financial-system/.

[8] JP Morgan and Schroders. Natural capital assets under management assumed to be $350bn based on Schroders Capital research and estimates. Global assets under management $175tn, taken from JP Morgan Alternative Investments Outlook and Strategy, February 2023.

[9] Climate Asset Management; US Farmland: NCREIF (National Council of Real Estate Investment Fiduciaries) Total Return Index; US Timberland: NCREIF Total Return Timberland Index; US Equities: S&P 500 Total Return Index; US HY Bonds: ICE BofA US High Yield Index Total Return Index; US IG Bonds: ICE BofA US Corporate Index Total Return Index; Inflation: Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, Seasonally Adjusted; Real Estate and Infrastructure: PREQIN Benchmark Index. Quarterly return time series from 2001–2025Q2.